Commercial properties that are rundown could face higher taxes in the future, as the city considers adding a derelict tax subclass for non-residential properties.

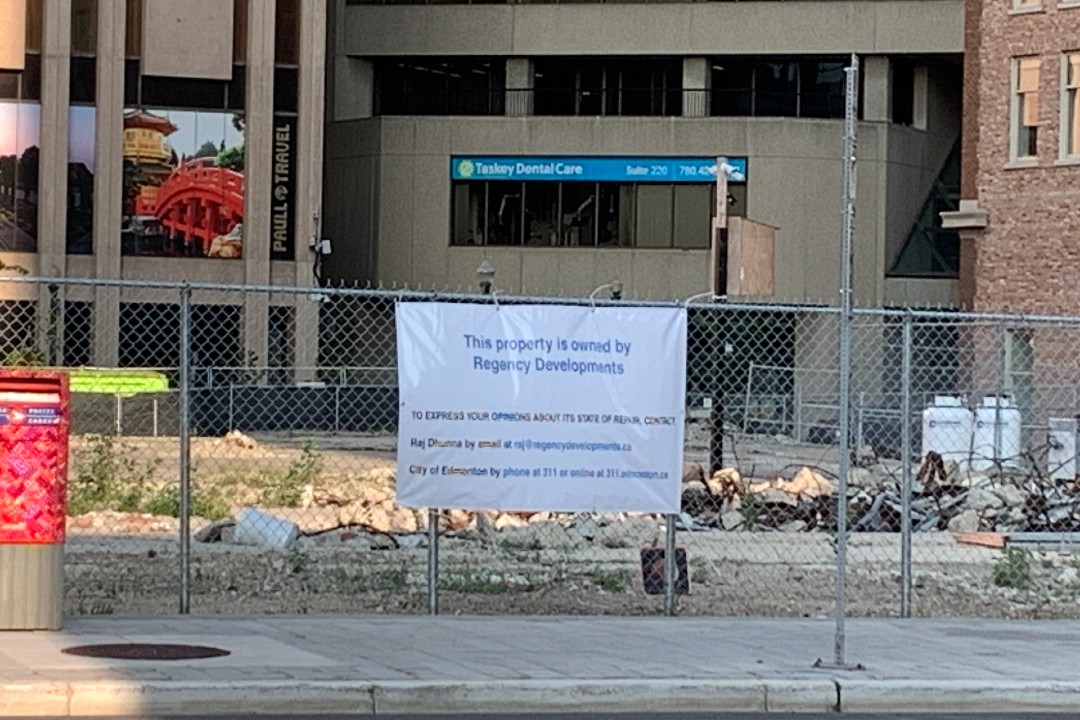

The derelict residential tax subclass, introduced in 2024, already charges the owners of properties in mature areas that are falling into significant disrepair a higher tax rate. Mayor Andrew Knack told Taproot that administration could add a subclass for non-residential buildings and properties that have become eyesores, specifically calling out the Regency Developments property at the corner of 102 Avenue and 101 Street in Edmonton's downtown as an example.

"That site is an embarrassment, and it's so troubling that it's been allowed to exist in that state," Knack said.

The city's problem property team is seeking input on the Regency site, where the Bank of Montreal building stood until it was demolished in 2018, to understand how people feel about it. The city told Taproot the survey does not directly relate to the proposed new tax subclass, and while there is overlap between problem properties and derelict properties, they're not the same thing. Problem properties are defined by their social and safety issues, while tax assessors look at the physical state of a building to determine if it's derelict.

Regardless, Knack indicated that the proposed new tax subclass could be used on the Regency property. "When you have a derelict site like that, which is being underutilized and is not contributing, (the owners) need to make one of two decisions: They either need to invest in it and turn it into something special, or they need to sell it to somebody who will," Knack said. "It's so critical that we have (tax tools) on the non-residential side, because it's been allowed to exist in that state for far too long."

Raj Dhunna, CEO of Regency Developments, told Postmedia that the COVID-19 pandemic, inflation, and supply-chain challenges meant that the once-proposed 50-storey mixed-use building at the site was no longer feasible. He said he felt unfairly targeted by the city's survey. "We are concerned that the city chose to issue a single-site survey without recognizing the broader context or the substantial challenges facing downtown," he said. "This is particularly troubling in light of unresolved issues within the city's own portfolio and citywide safety and security concerns that continue to impact residents and businesses alike. We remain committed to working collaboratively toward solutions that support downtown Edmonton's long-term success."

A report presented to a council committee in January about the derelict residential tax subclass explains some barriers to creating a similar subclass for non-residential properties. Provincial legislation mandates that a non-residential property must be unoccupied for at least one year before it can be assessed as derelict. The report said it would be hard to prove that a property was not occupied at any point during a calendar year with enough evidence to withstand an assessment complaint. The Municipal Government Act also requires that the highest non-residential tax rate be no more than five times the lowest residential rate, meaning a derelict non-residential tax subclass could only be about 70% higher than the general non-residential rate. "As compared to the roughly 200% increase applied to the residential derelict subclass, a relatively smaller tax increase may result in relatively modest outcomes," the report said.

In January, council's executive committee asked administration to outline a strategy to expand the subclass to non-residential properties. That strategy is due before council's executive committee in March 2026.

The city said the subclass for residential properties appears to have encouraged owners to demolish, remediate, or sell their properties. Administration assessed more than 200 residential properties as derelict in 2024. At least 23 such properties were demolished, and 10 were remediated that year. Edmonton was the first city in Canada to introduce a subclass for derelict residential properties, and administration said it has responded to inquiries about the subclass from other cities in Alberta and Saskatchewan. Council approved prorated tax forgiveness for derelict property owners to encourage them to clean up their properties faster. Owners can apply for forgiveness for the part of the year that their property was cleaned up or remediated.